highslice

Well-Known Member

- Mar 28, 2008

- 6,114

- Boat Info

- 270 SLX

2013 Sea Doo 155 Wake

- Engines

- 496 Mag

Bravo III

Corsa

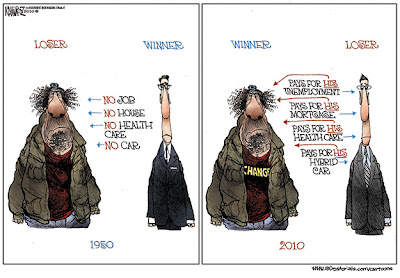

You all think you "only" give up 33% of your income to taxes? Smarten up. Add in the SS, Medicare, state, and local taxes, then your excise tax, property tax, and sales tax. You are well above 50%. You pay as much as the Swiss, but get only a fraction of the services. You're kids going to college for free? Sorry to hear you think that you only pay 33%.

Sorry, I meant income tax. No, trust me when I tell you I have a firm grip on where my money goes. I handle other people's money for a living, and I work a lot harder for me than I do for them. But at least the local taxes that we pay result in services that we can actually use. Any dollar sent to the IRS that isn't spent on the military provides nothing for my family. They just f'n piss it all away. So no reason to be sorry, my eyes are wide open.

One of my kids has a reasonably good chance of going to college for free, but that's because of his hard work and not the gobermint.