We sold off some of the weak/loser equities before the end of 22 to garner a needed tax offset. Foreseeing the market is going to be challenging through at least mid 23 we moved a chunk of non-qualified cash into 6-month Certificates at 4.22%. Normally, I'd move cash in a down market to Muni's but with all of the Fed money dumping into "infrastructure", Municipal Bonds may not be as good as they used to be....

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature currently requires accessing the site using the built-in Safari browser.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

An Investment Thread

- Thread starter mrsrobinson

- Start date

DylanBlake

New Member

Hey! I'm new here, but I love this kind of threads about investments. I learn from other people's mistakes and try to do better. Last year I invested into dividend stocks and I told my story on a thread too. It was my first big investment. I wrote about my mistakes and failures so that other investors could avoid them. Ar first, I avoided seeking professional advice in wealth management. Yet, then I understood there is nothing to be ashamed of. An expert opinion can guide you and make a great investment strategy.

SeaNile

Well-Known Member

I'm in with AMD @ 70 and NFLX @ 300. Think I am going to hang on to these for a while.

What does everyone think about Eli Lilly? They have a few huge FDA approvals on the horizon, stock is down a bit, etc. I'm thinking of jumping in considering Mounjaro really could be one of the biggest selling drugs of all time.

What does everyone think about Eli Lilly? They have a few huge FDA approvals on the horizon, stock is down a bit, etc. I'm thinking of jumping in considering Mounjaro really could be one of the biggest selling drugs of all time.

mrsrobinson

Well-Known Member

I've had absolutely no success with pharmaceutical stocks over the years so I stay away from them. I'm a big fan of AMD.

Lilly is headed down for a bit. Probably to the 330ish level. Earnings next week could change that.I'm in with AMD @ 70 and NFLX @ 300. Think I am going to hang on to these for a while.

What does everyone think about Eli Lilly? They have a few huge FDA approvals on the horizon, stock is down a bit, etc. I'm thinking of jumping in considering Mounjaro really could be one of the biggest selling drugs of all time.

SeaNile

Well-Known Member

TSLA? I bought some at 166 and regret not buying more. Thoughts on how this will go?

boatman37

Well-Known Member

- Jun 6, 2015

- 4,241

- Boat Info

- 2006 Crownline 250CR. 5.7 Merc BIII

Previous: 1986 Sea Ray 250 Sundancer. 260 Merc Alpha 1 Gen 1

- Engines

- 5.7 Merc BIII

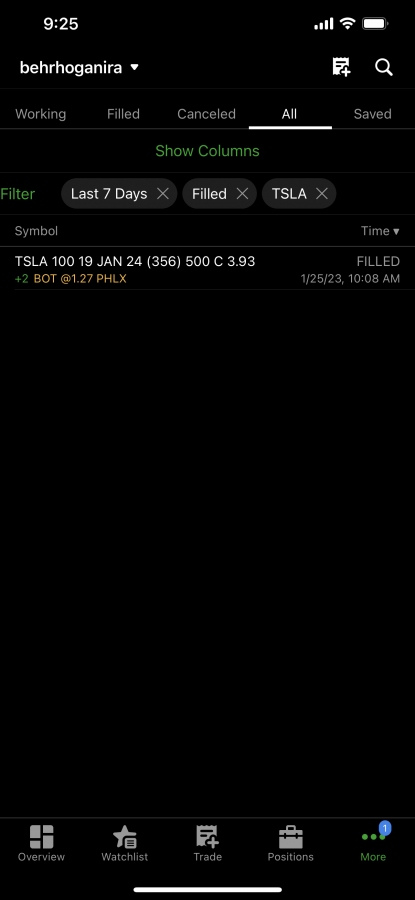

I bought Jan 2024 TSLA $500 calls a few days ago when it was at $139. As of close Friday I was up 222%. I paid $1.27 per contract and they closed yesterday at 4.07. Only have 2 contracts and was tempted to sell 1 but my plan was to hold these for a few months. I think it will hit $200 before we see a pullback but that is my opinion. We have relative equal highs which will be a big draw on liquidity so that's where I see it going. After that might see a pullback to sell side liquidity but will see how that plays out. I do have a sell order for 1 contract at $5.50, which will be real close to that $200 mark.

Keep in mind news trumps charts so if some bad news hits we could be back at $100 again.

Keep in mind news trumps charts so if some bad news hits we could be back at $100 again.

Morgan Jane

Active Member

Some trading advice that has worked very well for me for a long time:

Don't buy anything unless you know ahead of time exactly when you will exit either at a gain or a loss. And when it's there, exit. The point is don't use gut extinct or any recent movements of the market to help you determine the market's next movement.

Don't buy anything unless you know ahead of time exactly when you will exit either at a gain or a loss. And when it's there, exit. The point is don't use gut extinct or any recent movements of the market to help you determine the market's next movement.

mrsrobinson

Well-Known Member

Amazon and Alphabet reached a buying point for me, bought some Thursday, not for their retail business, rather their cloud, which I know.

No opinion on TSLA, I am not a fan of EV so I will never own it. Take a look at LCID.

No opinion on TSLA, I am not a fan of EV so I will never own it. Take a look at LCID.

boatman37

Well-Known Member

- Jun 6, 2015

- 4,241

- Boat Info

- 2006 Crownline 250CR. 5.7 Merc BIII

Previous: 1986 Sea Ray 250 Sundancer. 260 Merc Alpha 1 Gen 1

- Engines

- 5.7 Merc BIII

Exactly. If you have no plan then you will lose almost every time, even if you are up big but don't sell. I always use stops but in this case it was more of a lotto trade so I was willing to let them expire worthless. I felt it was a pretty good area to jump in and I bought lots of time.Some trading advice that has worked very well for me for a long time:

Don't buy anything unless you know ahead of time exactly when you will exit either at a gain or a loss. And when it's there, exit. The point is don't use gut extinct or any recent movements of the market to help you determine the market's next movement.

boatman37

Well-Known Member

- Jun 6, 2015

- 4,241

- Boat Info

- 2006 Crownline 250CR. 5.7 Merc BIII

Previous: 1986 Sea Ray 250 Sundancer. 260 Merc Alpha 1 Gen 1

- Engines

- 5.7 Merc BIII

With options I paid $1.27. That is $127.00 /per contract so only spent $254 but they are currently worth $814

SeaNile

Well-Known Member

All this time and I still have no idea what a call/option/put is. I just click "buy" and watch my money disappear.

Great point about the exit strategy. My AMC went from 14 to 70 (or so) and I never sold. Well, I sold some, made money and quickly invested it into other stocks and lost 80%. Not fun. 140k went to 700k which went to 400k and then settled at 90k. OUCH. Went from shopping for a 58DB to eating ramen noodles!!

Great point about the exit strategy. My AMC went from 14 to 70 (or so) and I never sold. Well, I sold some, made money and quickly invested it into other stocks and lost 80%. Not fun. 140k went to 700k which went to 400k and then settled at 90k. OUCH. Went from shopping for a 58DB to eating ramen noodles!!

Morgan Jane

Active Member

Great point about the exit strategy. My AMC went from 14 to 70 (or so) and I never sold. Well, I sold some, made money and quickly invested it into other stocks and lost 80%. Not fun. 140k went to 700k which went to 400k and then settled at 90k. OUCH. Went from shopping for a 58DB to eating ramen noodles!![/QUOTE]

Great example: In your wildest dream, when could you ever go from 140k to 700k? But for some reason you were hoping it would go to $1mil? But even if it did would you have sold it then? It seems to me that the whole system is set up to go against the small guy because they know our personalities. I have learned the hard way that it isn't about how much you make each time you invest, It's all about how many times you make something. If you can win something every time, you can't imagine how that compounds over time. Winning is not the goal. The goal should be not to lose. If you can figure out how to not lose, your golden. The only way to win 90% of the time is don't be greedy. Take your profit and move on. If you sell and it continues up and you could have made another 20%, so what. It could have gone down 20% too.

Options are 100% the way to make close to the same returns as owning the stock but options do not expose you to the big loses, which is really the goal. I use options and usually cash out long before the expiration date. But if things go sideways, I still have the possibility of waiting it out and at least recover some of my losses. I have done all the calculations, Options for us small guys are the way to go, especially if you like shorting things. Put options are the best defense against stock shorts that go the wrong way. If you like buying stocks long, then call options are okay but the down side to a long stock that drops is nowhere near as bad as a short stock that goes up expectantly. If you short a stock and the stock sky rockets while the market is closed, you can't close the position. Could cause a massive margin call and wipe you out. On the other hand a put option on that same stock over that same market closed time is protected. Long stocks don't seem to drop as volatile as short stocks can rise.

So the only reason you went from 140K to 90K was because that's how it works. Someone much smarter than you took $50k from you. Like I said, don't buy anything unless you know when you will sell it. Another thing I live and die by is this. The guys that we make money off are much smarter than we are. The Wall Streeters are geniuses. That is who you are betting against. When you went from 140k to 700k, you had taken $560k from some smart dudes. Once you make some money, never ever reinvest that money right away, ever. Don't kid yourself, if you made money, they want it back, They are hopping you will reinvest. Don't. Give it 30 days till the smoke clears. Stay in cash. Seriously. I look at the Market as a big Sine wave. When you hit the wave right, Great! But the market is getting ready to go the other way, so stay out. Get back once the wave starts back in your favorable direction. There is a rhythm to the market. It was on pretty steady rythm up from 2009 to 2020, but even during that time, it ocillated up and down along the way. So, make some money, then sit on the sidelines for a little. Don't feel compelled to always be in. Sitting on the sidelines may mean you aren't making anything, but I can assure you, you aren't losing and that is the real goal. NOT TO LOSE. Take a 100k. make 10%, then lose 10%. You just lost 1%. No losing is the key. Not winning big.

Great example: In your wildest dream, when could you ever go from 140k to 700k? But for some reason you were hoping it would go to $1mil? But even if it did would you have sold it then? It seems to me that the whole system is set up to go against the small guy because they know our personalities. I have learned the hard way that it isn't about how much you make each time you invest, It's all about how many times you make something. If you can win something every time, you can't imagine how that compounds over time. Winning is not the goal. The goal should be not to lose. If you can figure out how to not lose, your golden. The only way to win 90% of the time is don't be greedy. Take your profit and move on. If you sell and it continues up and you could have made another 20%, so what. It could have gone down 20% too.

Options are 100% the way to make close to the same returns as owning the stock but options do not expose you to the big loses, which is really the goal. I use options and usually cash out long before the expiration date. But if things go sideways, I still have the possibility of waiting it out and at least recover some of my losses. I have done all the calculations, Options for us small guys are the way to go, especially if you like shorting things. Put options are the best defense against stock shorts that go the wrong way. If you like buying stocks long, then call options are okay but the down side to a long stock that drops is nowhere near as bad as a short stock that goes up expectantly. If you short a stock and the stock sky rockets while the market is closed, you can't close the position. Could cause a massive margin call and wipe you out. On the other hand a put option on that same stock over that same market closed time is protected. Long stocks don't seem to drop as volatile as short stocks can rise.

So the only reason you went from 140K to 90K was because that's how it works. Someone much smarter than you took $50k from you. Like I said, don't buy anything unless you know when you will sell it. Another thing I live and die by is this. The guys that we make money off are much smarter than we are. The Wall Streeters are geniuses. That is who you are betting against. When you went from 140k to 700k, you had taken $560k from some smart dudes. Once you make some money, never ever reinvest that money right away, ever. Don't kid yourself, if you made money, they want it back, They are hopping you will reinvest. Don't. Give it 30 days till the smoke clears. Stay in cash. Seriously. I look at the Market as a big Sine wave. When you hit the wave right, Great! But the market is getting ready to go the other way, so stay out. Get back once the wave starts back in your favorable direction. There is a rhythm to the market. It was on pretty steady rythm up from 2009 to 2020, but even during that time, it ocillated up and down along the way. So, make some money, then sit on the sidelines for a little. Don't feel compelled to always be in. Sitting on the sidelines may mean you aren't making anything, but I can assure you, you aren't losing and that is the real goal. NOT TO LOSE. Take a 100k. make 10%, then lose 10%. You just lost 1%. No losing is the key. Not winning big.

mrsrobinson

Well-Known Member

Watching Barrett Jackson this weekend we should invest in these cars!

northshore

Well-Known Member

- Jan 17, 2011

- 2,089

- Boat Info

- 1989 340 Sundancer

Raymarine E90W Radar/Chartplotter

- Engines

- Twin 454 Mercruiser 340's

I

If you want to see money being burned up, the Rolex 24 is on as well…

Watching Barrett Jackson this weekend we should invest in these cars!

If you want to see money being burned up, the Rolex 24 is on as well…

mrsrobinson

Well-Known Member

I think you need to determine what your goal is before you start investing in individual stocks as well. Are you looking short-term to make some money, are you looking long-term for retirement, etc.

mrsrobinson

Well-Known Member

VIN number one, build your own vehicle, Mustang 2024 sold for half a million dollars. Not a bad looking car by the way with V8s.I

If you want to see money being burned up, the Rolex 24 is on as well…

SeaNile

Well-Known Member

Great point about the exit strategy. My AMC went from 14 to 70 (or so) and I never sold. Well, I sold some, made money and quickly invested it into other stocks and lost 80%. Not fun. 140k went to 700k which went to 400k and then settled at 90k. OUCH. Went from shopping for a 58DB to eating ramen noodles!!

Great example: In your wildest dream, when could you ever go from 140k to 700k? But for some reason you were hoping it would go to $1mil? But even if it did would you have sold it then? It seems to me that the whole system is set up to go against the small guy because they know our personalities. I have learned the hard way that it isn't about how much you make each time you invest, It's all about how many times you make something. If you can win something every time, you can't imagine how that compounds over time. Winning is not the goal. The goal should be not to lose. If you can figure out how to not lose, your golden. The only way to win 90% of the time is don't be greedy. Take your profit and move on. If you sell and it continues up and you could have made another 20%, so what. It could have gone down 20% too.

Options are 100% the way to make close to the same returns as owning the stock but options do not expose you to the big loses, which is really the goal. I use options and usually cash out long before the expiration date. But if things go sideways, I still have the possibility of waiting it out and at least recover some of my losses. I have done all the calculations, Options for us small guys are the way to go, especially if you like shorting things. Put options are the best defense against stock shorts that go the wrong way. If you like buying stocks long, then call options are okay but the down side to a long stock that drops is nowhere near as bad as a short stock that goes up expectantly. If you short a stock and the stock sky rockets while the market is closed, you can't close the position. Could cause a massive margin call and wipe you out. On the other hand a put option on that same stock over that same market closed time is protected. Long stocks don't seem to drop as volatile as short stocks can rise.

So the only reason you went from 140K to 90K was because that's how it works. Someone much smarter than you took $50k from you. Like I said, don't buy anything unless you know when you will sell it. Another thing I live and die by is this. The guys that we make money off are much smarter than we are. The Wall Streeters are geniuses. That is who you are betting against. When you went from 140k to 700k, you had taken $560k from some smart dudes. Once you make some money, never ever reinvest that money right away, ever. Don't kid yourself, if you made money, they want it back, They are hopping you will reinvest. Don't. Give it 30 days till the smoke clears. Stay in cash. Seriously. I look at the Market as a big Sine wave. When you hit the wave right, Great! But the market is getting ready to go the other way, so stay out. Get back once the wave starts back in your favorable direction. There is a rhythm to the market. It was on pretty steady rythm up from 2009 to 2020, but even during that time, it ocillated up and down along the way. So, make some money, then sit on the sidelines for a little. Don't feel compelled to always be in. Sitting on the sidelines may mean you aren't making anything, but I can assure you, you aren't losing and that is the real goal. NOT TO LOSE. Take a 100k. make 10%, then lose 10%. You just lost 1%. No losing is the key. Not winning big.[/QUOTE]

So you are saying don't buy 50k worth of TSLA first thing Monday morning??

Nater Potater

Well-Known Member

- Oct 19, 2020

- 2,640

- Boat Info

- 1992 300DA Sundancer

- Engines

- Twin Merc Alpha I Gen II I/O's with 5.7 V8's

I bought some Vale SA back in late November when it was around $14.50, then sold it about a month later for around $17.00 when it started a pretty steep drop. Stupid me; it's continued on up to over $19.00 a month later. I really can't complain as I made money off of it.

Morgan Jane

Active Member

Great example: In your wildest dream, when could you ever go from 140k to 700k? But for some reason you were hoping it would go to $1mil? But even if it did would you have sold it then? It seems to me that the whole system is set up to go against the small guy because they know our personalities. I have learned the hard way that it isn't about how much you make each time you invest, It's all about how many times you make something. If you can win something every time, you can't imagine how that compounds over time. Winning is not the goal. The goal should be not to lose. If you can figure out how to not lose, your golden. The only way to win 90% of the time is don't be greedy. Take your profit and move on. If you sell and it continues up and you could have made another 20%, so what. It could have gone down 20% too.

Options are 100% the way to make close to the same returns as owning the stock but options do not expose you to the big loses, which is really the goal. I use options and usually cash out long before the expiration date. But if things go sideways, I still have the possibility of waiting it out and at least recover some of my losses. I have done all the calculations, Options for us small guys are the way to go, especially if you like shorting things. Put options are the best defense against stock shorts that go the wrong way. If you like buying stocks long, then call options are okay but the down side to a long stock that drops is nowhere near as bad as a short stock that goes up expectantly. If you short a stock and the stock sky rockets while the market is closed, you can't close the position. Could cause a massive margin call and wipe you out. On the other hand a put option on that same stock over that same market closed time is protected. Long stocks don't seem to drop as volatile as short stocks can rise.

So the only reason you went from 140K to 90K was because that's how it works. Someone much smarter than you took $50k from you. Like I said, don't buy anything unless you know when you will sell it. Another thing I live and die by is this. The guys that we make money off are much smarter than we are. The Wall Streeters are geniuses. That is who you are betting against. When you went from 140k to 700k, you had taken $560k from some smart dudes. Once you make some money, never ever reinvest that money right away, ever. Don't kid yourself, if you made money, they want it back, They are hopping you will reinvest. Don't. Give it 30 days till the smoke clears. Stay in cash. Seriously. I look at the Market as a big Sine wave. When you hit the wave right, Great! But the market is getting ready to go the other way, so stay out. Get back once the wave starts back in your favorable direction. There is a rhythm to the market. It was on pretty steady rythm up from 2009 to 2020, but even during that time, it ocillated up and down along the way. So, make some money, then sit on the sidelines for a little. Don't feel compelled to always be in. Sitting on the sidelines may mean you aren't making anything, but I can assure you, you aren't losing and that is the real goal. NOT TO LOSE. Take a 100k. make 10%, then lose 10%. You just lost 1%. No losing is the key. Not winning big.

So you are saying don't buy 50k worth of TSLA first thing Monday morning??[/QUOTE]

I would have to look at a bunch of other factors. First off, what's telling you to buy? I wouldn't buy anything based on something that just happened. If that's your signal, you are too late. Just like I don't buy unless I know when I will sell, I also won't enter a position unless I have tracked it for good while and it meets my criteria to enter a purchase. Example, Something like, "only buy Tesla if it drops to less than 40% of it's 6 month high and then moves back up 5%" Another good piece of advise is that you will never buy at the bottom or sell at the top. You just won't. It's impossible. If you happen to, you just go lucky. I try to buy on the way up just past a pre determined low and sell one on the way back down after a recent high. Good luck with that but that's what I'm trying to do. Set your criteria to enter a trade, when it's there, enter the trade. When the criteria to exit is met. Get out. Period. Don't read the headlines, Don't listen to Kramer, Don't use gut instinct, and certainly don't use emotions. It's a numbers game, that's all it is. It's roulette, but you get to decide when you do and don't play.