I have watched this company buy Marina's all over the country the last few years. They bought 3 marinas I have been in in just the last 4 years on Erie and St Clair... I have heard both arguments on the return on investment of Marina's...and it just doesn't seem to be worth the risk... but this company seems to have a different equation going on at the rate they are growing. Just found it interesting...

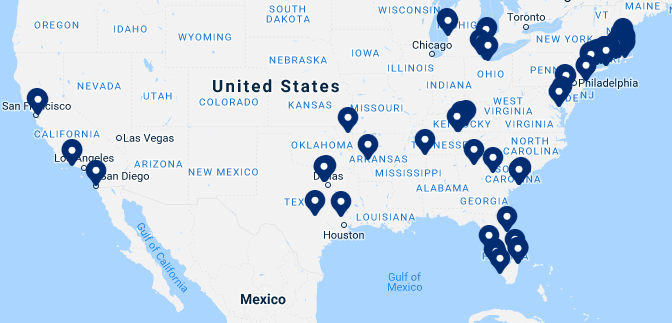

https://shmarinas.com/locations/

https://shmarinas.com/locations/

Last edited: